Wall Street Ends Higher as Tech Leads the Way

U.S. stock markets closed Wednesday with solid gains, bolstered by a more than 1 percent surge in the Nasdaq index. Positive earnings reports and bold announcements from major corporations helped lift investor sentiment.

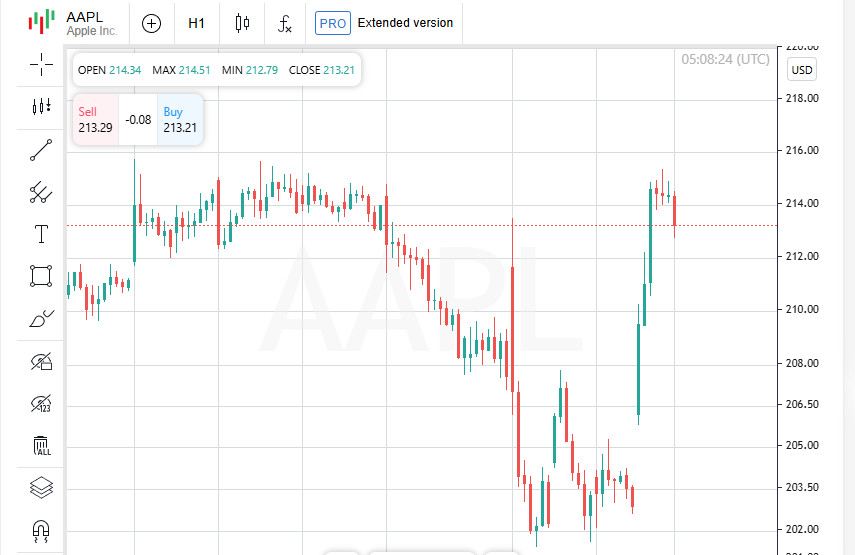

Apple Jumps After Massive Investment News

Apple shares soared by 5.1 percent following a statement from a White House official indicating that the tech giant plans to invest $100 billion into domestic manufacturing. The announcement sparked strong enthusiasm among investors, pushing Apple to lead gains across all three major indexes.

McDonald's Surprises With Strong Global Sales

Shares of McDonald's rose 3 percent after the fast-food chain reported global sales from its value menu exceeded expectations. The results reflect resilient consumer demand despite broader economic uncertainty.

Arista Networks Delivers a Blowout Forecast

The standout performer of the day was Arista Networks. Its stock jumped by 17.5 percent after the cloud networking company projected higher-than-expected revenue for the current quarter, surpassing analysts' forecasts and fueling investor optimism.

Earnings Season Outshines Projections

So far, around 400 companies in the S&P 500 have released their earnings for the second quarter. According to LSEG, approximately 80 percent have reported profits above analyst estimates — notably higher than the 76 percent average of the past four quarters. Earnings growth for the quarter is estimated at 12.1 percent, more than double the early July forecast of 5.8 percent.

Key Market Indexes at Close:

- Dow Jones rose by 81.38 points, or 0.18 percent, closing at 44,193.12;

- S&P 500 gained 45.87 points, up 0.73 percent, ending the session at 6,345.06;

- Nasdaq Composite jumped 252.87 points, or 1.21 percent, finishing at 21,169.42.

Rate Cut Hopes Drive Market Optimism

Investor sentiment was lifted by growing expectations that the Federal Reserve may cut interest rates in September. The latest U.S. jobs report pointed to a cooling labor market, along with downward revisions for previous months — both factors reinforcing hopes for monetary easing.

According to CME's FedWatch Tool, the probability of a 25 basis point rate cut in September surged to 95.2 percent. That's up from 92.9 percent the previous day and significantly higher than last week's 46.7 percent.

AMD and Super Micro Take a Hit

Not all earnings news was positive. Shares of Advanced Micro Devices tumbled 6.4 percent after the company reported underwhelming performance in its data center segment. Super Micro Computer fared even worse, with its stock plummeting by 18.3 percent.

Disney Beats Expectations but Slips

Walt Disney reported strong quarterly numbers and upgraded its full-year outlook. However, despite the positive report, the company's shares declined by 2.7 percent, as some investors remained cautious.

Market Eyes Trump's Fed Pick

Adding to the market's focus is anticipation surrounding Donald Trump's expected announcement of a new appointee to the Federal Reserve Board of Governors. Any change in Fed leadership could have meaningful implications for future policy.

Japanese Markets Hit All-Time Highs

Asian stocks closed higher on Thursday, led by a surge in Japanese equities. The broad-based Topix index climbed 0.9 percent, reaching an all-time high, while the Nikkei advanced by a similar margin. Investor sentiment was lifted by Wall Street's tech-driven rally, strong earnings results, and easing expectations for U.S. interest rate hikes.

Taiwan and South Korea Extend Gains

Taiwan's benchmark TWII index jumped 2.3 percent, touching its highest point in over a year. Meanwhile, South Korea's KOSPI rose by 0.6 percent, bolstered by positive global momentum and steady investor confidence.

Modest Growth in China and Hong Kong

Hong Kong's Hang Seng index increased by 0.4 percent, and mainland China's CSI300 gained 0.3 percent. Though more restrained, the movement still reflected cautious optimism surrounding China's economic outlook.

Australian Shares Take a Breather

Australian stocks edged slightly lower, retreating after reaching a record high on Wednesday. The dip appeared to be a technical correction rather than a sign of broader weakness.

Pound Holds Firm Ahead of BoE Decision

The British pound remained stable at 1.3356 against the dollar, trading near a weekly high. Markets were closely watching for the Bank of England's policy announcement later in the day. A 25 basis point rate cut was widely expected, with attention focused on potential divisions within the central bank's board.

Dollar Dips as Fed Outlook Shifts

The U.S. dollar lost ground against major currencies amid growing speculation that the Federal Reserve may adopt a more dovish stance. Weaker-than-expected jobs data and reports of upcoming Fed appointments by Donald Trump — likely favoring a looser policy — contributed to the shifting outlook. The potential for new Fed board members aligning with Trump's monetary views added to investor expectations of rate cuts.

Dollar Regains Some Ground After Sharp Decline

Following a steep drop of 0.6 percent on Wednesday, the U.S. dollar index edged slightly higher to 98.245. This index tracks the dollar's performance against a basket of six major currencies, including the euro and the pound.

Euro Holds Steady After Previous Surge

The euro remained virtually unchanged at 1.1657 dollars, holding on to gains from the prior session, when it climbed 0.7 percent as the dollar weakened.

Bank of England Faces Divided Vote

The Bank of England is expected to cut interest rates for the fifth time in a year during its Thursday meeting. However, the decision is likely to be contentious. Analysts anticipate a split vote, with some policymakers advocating a half-point cut, while others push to leave rates unchanged due to ongoing inflation concerns.

Yen Slightly Weaker Against the Dollar

The dollar edged up by 0.1 percent against the Japanese yen, trading at 147.53 yen, reflecting modest dollar strength in a cautious market.

Gold Rises on Softer Dollar

Gold prices gained 0.4 percent to approximately 3382 dollars per ounce. The precious metal found support as the dollar eased, prompting investors to seek safety in traditional hedges.

Oil Prices Bounce After Losses

Crude oil rebounded slightly after both Brent and West Texas Intermediate lost around one percent the previous day. Brent futures rose by 20 cents to 67.09 dollars a barrel, while WTI added 22 cents to reach 64.57 dollars. The modest gains offered relief amid lingering market volatility.