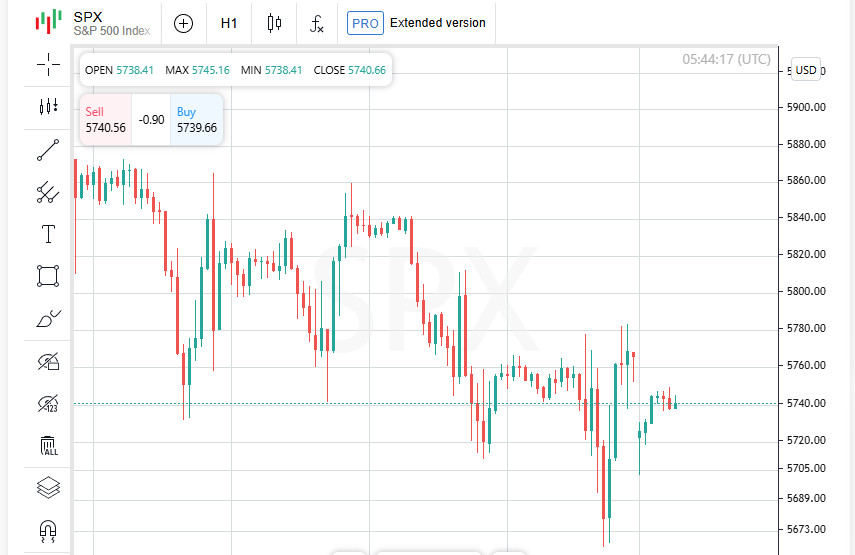

Wall Street loses ground

The new trading day in global markets began with significant losses. Futures on US stock indices dropped: S&P 500 declined by 0.5%, while Nasdaq lost 0.6%. Investors remain anxious about flagging economic growth in the US and escalating global trade tensions.

Asian markets are mostly down, except Japan

Asian markets also reacted negatively to the latest news. Hong Kong's Hang Seng and China's CSI 300 fell by 0.1%, while Taiwan's TWII lost 0.4%. However, Japan's Nikkei managed to post a slight gain of 0.2%, fluctuating between minor losses and gains.

Safe-haven assets gain bullish momentum

Amid mounting instability, investors shifted focus to safe-haven assets. The Japanese yen strengthened by 0.6% to 147.245 per dollar. The Swiss franc gained 0.4%, reaching 0.8773 per dollar. This trend highlights the growing demand for safe currencies as global economic uncertainty persists.

China's deflation raises concerns

New economic data from China further fueled fears. In February, China's consumer price index (CPI) plunged at the fastest pace in 13 months, while producer price deflation extended for the 30th consecutive month—a clear sign of weakness in the industrial sector.

In response, Chinese authorities pledged additional economic stimulus measures, focusing on boosting consumer spending and advancing AI and high-tech industries. These statements came during the National People's Congress meetings in Beijing, set to continue until Tuesday.

Trump avoids recession forecasts

Meanwhile, across the globe, US President Donald Trump dodged questions about the economic impact of his tariffs on China, Canada, and Mexico in an interview with Fox News. When asked whether they could trigger a recession in the US, Trump refused to give a direct answer, leaving investors even more uncertain.

The economic situation continues to escalate, and markets remain on edge, searching for clear signals on future direction.

US NFPs defy consensus

The latest US employment report added to investor concerns. Friday's labor market data showed fewer job gains than expected, marking the first full reflection of the economic impact of Trump's trade policies.

Analysts: Trump's policies are destabilizing markets

According to analysts, Trump's economic approach is fueling uncertainty. Kyle Rodda, Senior Market Analyst at Capital.com, stated: "Unlike his first term, when economic slowdowns or stock market drops forced him to adjust course, this time he is focused on long-term structural reforms—even if they come at short-term costs." This strategic shift worries investors, who were accustomed to more flexible economic responses.

US Treasury yields drop as investors seek safety

The market reaction was swift, as investors rushed into US Treasuries, leading to a decline in yields:

- 10-year Treasury yield fell by 6 basis points to 4.257%.

- 2-year Treasury yield dropped by 4.5 basis points to 3.956%.

- The euro rose 0.3% to $1.0866.

- The British pound gained 0.2%, reaching $1.2946.

- US budget negotiations and potential government shutdown risk;

- US inflation data and its impact on Federal Reserve policy;

- Trump's next moves in the trade war

This trend reflects a rising demand for lower-risk assets amid economic uncertainty.

The US dollar weakens amid market volatility

The US dollar also lost ground. Its index, which tracks the greenback against six major currencies, dipped by 0.1% to 103.59 points.

Both dollar weakness and lower bond yields highlight lingering investor concerns about the outlook for the US economy.

Euro and Pound strengthen

As the US dollar struggles, European currencies gained traction:

The rally in European currencies is partially driven by dollar weakness, as investors hedge against uncertainty by shifting to alternative assets.

Trump threatens Canada with new tariffs

The trade war continues to escalate. On Friday, Trump made new threats against Canada, hinting at potential tariffs on dairy products and lumber. These threats have already impacted commodity markets, forcing investors to reassess global trade forecasts.

Oil prices under pressure

The oil market reacted negatively to new trade threats, pushing prices lower:

* Brent crude futures fell 0.4% to $70.11 per barrel.

* US WTI crude lost 0.4%, slipping to $66.76 per barrel.

Concerns over global economic slowdown weigh on crude prices, despite OPEC's efforts to stabilize the market.

Gold remains a safe haven

Gold, the traditional safe-haven asset, rose by 0.15% to $2,915 per troy ounce, as investors seek refuge amid stock market turmoil and trade conflicts.

Bitcoin plummets after disappointing executive order

The cryptocurrency market faced another major sell-off. Bitcoin lost 7.2% over the weekend, dropping to a monthly low of $80,085.42. In January, Bitcoin hit an all-time high of $109,071.86, fueled by expectations of weaker regulations under Trump and the potential creation of a US government crypto reserve. However, Friday's executive order disappointed investors, confirming that the US has no plans to expand Bitcoin purchases, sparking panic selling.

US stock market remains under pressure

Investors anxiously await the upcoming US inflation report, which could further shake the stock market. Despite a small rebound on Friday, the S&P 500 ended its worst week in six months. The Nasdaq Composite officially entered correction territory, plunging over 10% from its December highs. Markets remain on edge, as investors closely watch economic indicators and upcoming decisions from Trump's administration and the Federal Reserve.

Global economic shocks are going on

Markets remain on a knife's edge, struggling with rapid shifts in US economic policy. Trump's tariff hikes on Mexico, Canada, and China intensified trade tensions. Germany announced major fiscal expansion, triggering a bond sell-off in the eurozone.

Will the Federal Reserve step in?

Despite rising uncertainty, there is one silver lining: weak US economic data has increased market expectations for Federal Reserve rate cuts. However, this optimism may be short-lived. If next week's US inflation data shows persistent inflationary pressures, the Fed may keep interest rates elevated for longer than expected.

Stagflation: the worst-case scenario?

More investors are discussing the growing risk of stagflation—a situation where the economy slows while inflation remains high. This would be a nightmare scenario for markets, as it reduces consumer purchasing power and strains corporate profits.

Key market drivers to watch this trading week

Any unexpected developments could trigger another wave of market turmoil, forcing investors to revise their strategies.