Analysis of Tuesday's Trades

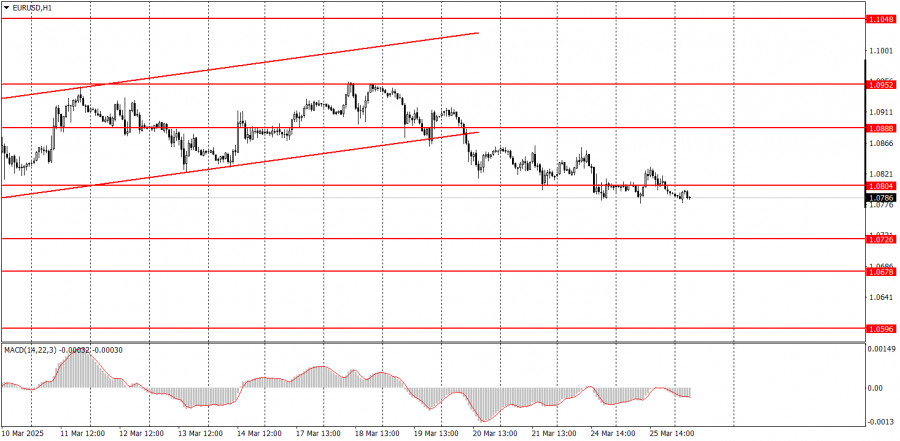

1H Chart of EUR/USD

On Tuesday, the EUR/USD currency pair continued its weak downward movement. This is visible on any illustration of any timeframe, after a strong and fairly prolonged rise in the euro — which represents a correction on the daily timeframe — a new correction has started, this time on the lower timeframes. Unfortunately, fundamental, macroeconomic, and technical analyses contradict each other. The market continues to focus solely on Donald Trump's trade policy and ignores the strength of the U.S. economy. As a result, many economic reports are disregarded. From a technical standpoint, the euro has already exceeded its growth target. Since the overall downtrend remains in place, a decline toward price parity should be expected. However, it is extremely difficult to imagine the U.S. dollar strengthening to parity under current market and global conditions. There were no major events in the Eurozone or the U.S. yesterday, which explains the low volatility.

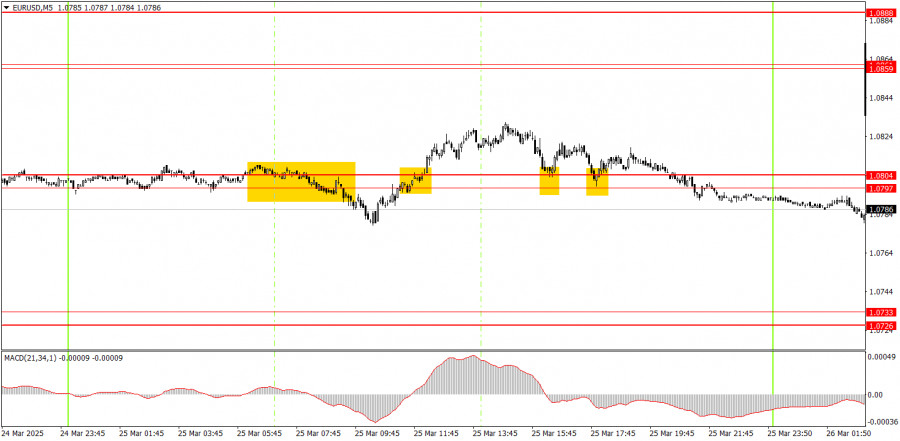

5M Chart of EUR/USD

On the 5-minute timeframe, four signals were generated on Tuesday, but due to extremely weak volatility, none of them were successfully executed. It's important to remember that the entire upward movement of the euro is just a correction. The current decline is, in turn, a correction within a correction. Thus, by definition, this move cannot be strong. Only in the second of the four signals did the price move at least 15 pips in the desired direction.

Trading Strategy for Wednesday:

In the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, although the chances of its continuing are decreasing. Since the fundamental and macroeconomic background still favors the U.S. dollar much more than the euro, we continue to expect a decline. However, Donald Trump keeps pushing the dollar downward with frequent tariff decisions and statements about the U.S.-desired world order. Fundamentals and macroeconomics remain overshadowed by politics and geopolitics, so we do not expect strong dollar growth now.

On Wednesday, the euro may continue to decline. For the first time in a while, the market responded appropriately to fundamentals (the Federal Reserve meeting), and from a technical standpoint, the pair has exited the ascending channel. Recently, the dollar has become oversold and unjustifiably cheap, so a correction is likely.

On the 5-minute timeframe, the following levels should be considered: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, and 1.1048. On Wednesday, no crucial events or reports are scheduled in the Eurozone, while in the U.S., a reasonably significant report on durable goods orders will be released. This is the only event of the day that could impact the pair's movement.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.