US market declines amid weak earnings and Fed expectations

On Tuesday, US stock indices closed in negative territory. The S&P 500 and Nasdaq pulled back from their record highs following disappointing corporate reports, while investors opted for a wait-and-see approach ahead of the Federal Reserve's policy announcement.

Dow under pressure: insurers and aerospace stocks drag index lower

Among Dow Jones components, UnitedHealth, Boeing, and Merck reported quarterly results, with all three stocks closing lower. UnitedHealth shares plunged by 7.5% after the company cut its earnings guidance, becoming the main drag on the entire index. Boeing shares lost 4.4%, despite the company posting a smaller-than-expected loss in the second quarter.

Pharma and vaccines: Merck delays shipments to China

Pharmaceutical giant Merck also reported financial results and announced an extension of the suspension of its Gardasil HPV vaccine shipments to the Chinese market until at least the end of 2025 due to persistently low demand. Against this background, its shares dropped by 1.7%.

Tech giants take center stage this week

Investors are eagerly awaiting earnings reports from mega-cap market leaders, including Meta, Microsoft, Amazon, and Apple. Their results traditionally have a significant impact on stock market dynamics due to their massive index weightings.

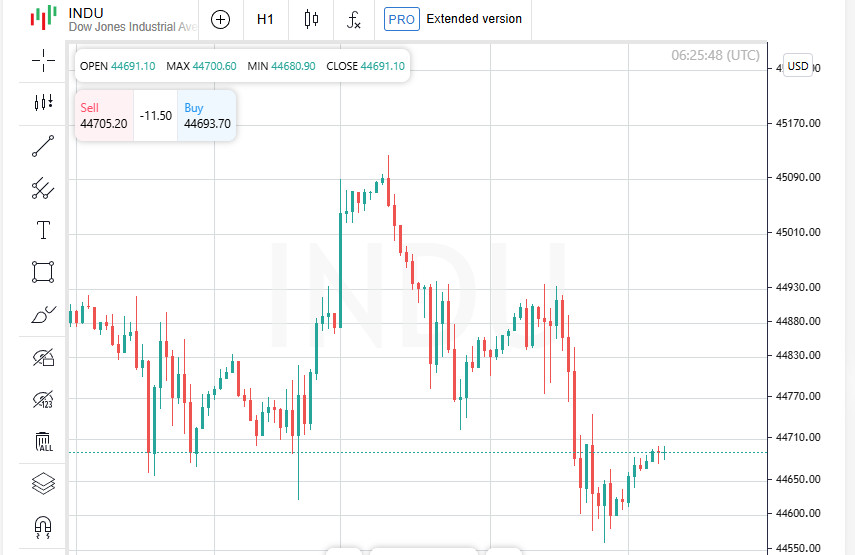

Trading summary

The Dow Jones Industrial Average fell by 204.57 points, or 0.46%, closing at 44,632.99. The S&P 500 lost 18.91 points, or 0.30%, ending the day at 6,370.86. The Nasdaq Composite dropped by 80.29 points, or 0.38%, to settle at 21,098.29.

UPS and Whirlpool drag transport index down

United Parcel Service shares tumbled by 10.6% after releasing its quarterly report. The parcel delivery company once again refrained from issuing full-year revenue and margin guidance, intensifying investor concerns that US President Donald Trump's unstable trade policy is putting pressure on business.

The decline in UPS shares contributed to a 2.3% drop in the Dow Jones Transport Average, marking the index's largest one-day fall since May 21.

Whirlpool cuts forecasts and loses capitalization

Whirlpool shares plunged by 13.4%. The home appliance manufacturer revised its annual profit and dividend guidance downward. The company explained that pressure had intensified due to an increase in imports from competitors ahead of tariff implementation by the Trump administration.

Procter and Gamble raises prices and disappoints investors

Procter and Gamble shares slipped by 0.3%. The consumer goods maker, known for detergents and hygiene products, issued an annual forecast below market expectations. In addition, the company announced price hikes on a range of products in an attempt to offset the impact of tariffs.

Investors await Fed decision and trade negotiation updates

The Federal Reserve is expected to leave the key interest rate unchanged following Wednesday's meeting. Market participants are focused on Fed Chair Jerome Powell's comments, which are expected to provide insight into the potential timing of future rate cuts.

Meanwhile, the second day of US-China negotiations aimed at resolving the trade conflict between the world's two largest economies concluded in Stockholm. President Trump stated that, according to Treasury Secretary Scott Bessent, the American delegation's meeting with Chinese representatives was extremely productive.

Cautious gains: Asian markets edge higher ahead of Fed policy decision

Asian stock exchanges saw moderate gains on Wednesday, despite persistent tensions in global trade. Investors remained cautious after another round of US-China talks ended without major agreements, shifting their focus to the upcoming Federal Reserve statement on monetary policy.

Taiwan gains, Japan and Hong Kong lose ground

The MSCI Asia-Pacific Index rose by 0.3%, driven by a rally in Taiwan's stock market. Meanwhile, Japan's Nikkei slipped by 0.03%, and Hong Kong's Hang Seng dropped by 0.4%. Australia outperformed the region, gaining 0.7%.

Euro rebounds slightly

The euro added 0.2%, bouncing off a one-month low and reaching the 1.1564 level. The currency found support from optimistic expectations surrounding the trade agreement between the European Union and the administration of US President Donald Trump.

Central bank decisions and tariff deadline in focus

Traders are bracing for a packed schedule of economic events. Key decisions from central banks, corporate earnings releases, and critical macroeconomic data are expected in the coming days. The central event of the week may be a statement from US President Donald Trump regarding potential new tariffs starting August 1.

Fed holds steady on rates, but views may diverge

The Federal Reserve is expected to leave the benchmark interest rate unchanged. However, some members of the committee may dissent and advocate for lower borrowing costs.

US Treasury yields decline

Demand for US Treasuries rose ahead of the Fed meeting, pushing yields to their lowest levels in nearly a month. A successful auction of seven-year notes helped ease concerns about weakening demand for government debt.

Bank of Japan in no hurry to shift course

On Thursday, the Bank of Japan is expected to keep its key interest rate steady. Investor focus will center on the regulator's commentary, which may clarify the timeline for possible rate hikes. The chance of policy tightening has reemerged following the trade agreement with the US, which gave the Bank of Japan room to maneuver.

Trade talks stall

Meanwhile, global trade tensions are mounting. Ahead of President Trump's deadline for reaching a deal that could avert new tariffs, negotiations between the US and several countries are teetering on the brink of failure.

US and China extend truce, but no breakthrough

On Tuesday, US and Chinese officials agreed to extend the 90-day tariff truce. However, no substantial outcomes were announced. According to US representatives, President Trump is expected to decide soon whether to prolong the trade pause, which expires on August 12, or allow tariffs to return to triple-digit levels.

India and South Korea seek way out

India is also preparing for a potential increase in US tariffs on a range of export goods by 20-25%. Sources within the Indian government note that the country does not intend to make new trade concessions ahead of the August 1 deadline. Simultaneously, in Seoul, three ministers from South Korea's cabinet held talks with US Trade Representative Howard Lutnick in a last-minute effort to reach an agreement.

Oil rises amid geopolitical uncertainty

Brent crude prices rose by 14 cents, or 0.19%, on Wednesday, reaching $72.65 per barrel.