The GBP/USD currency pair once again traded rather calmly on Wednesday, but the scales are slowly tipping in favor of the British pound (and the euro as well). The market has been taking a break from last week's events for several days, yet news continues to pour in from across the ocean in a steady stream. There are Donald Trump's new large-scale tariffs, his nuclear threats toward Russia, the dismissal of the head of the U.S. Bureau of Statistics, and new disappointing macroeconomic data (the ISM Services Index for the U.S.). In our view, a renewed decline in the dollar is only a matter of time.

Today, the Bank of England will also hold a meeting, but against the backdrop of all these other events, even the British central bank's meeting doesn't seem particularly interesting. According to expert forecasts, the BoE plans to cut the key rate by another 0.25%, which would mark the third step in easing monetary policy this year. Overall, at the beginning of the year, the Bank promised four rate cuts and is currently sticking to that schedule. However, we doubt that a majority of the Monetary Policy Committee members will vote for a rate cut tomorrow.

Only one factor stands against a dovish decision—and that is inflation. But this is the most important factor. Over the past year, inflation in the UK has only been accelerating, so we're no longer talking about one or two bad months, but an entire trend. That is, we can safely say that inflation is rising in the UK. And if inflation is rising, how can there be talk of a rate cut? Especially since inflation is not just near the 2% target—where, in principle, some deviation could still be acceptable—but has almost doubled the target level.

Therefore, if the BoE proceeds with another round of easing, inflation may accelerate even further. Of course, the BoE surely employs economists and analysts capable of forecasting a slowdown in inflation, say, over the next six months. Perhaps based on such a forecast, it would be reasonable to cut the rate in August. However, in our opinion, global prices will continue rising across the board. Trump's trade war will push prices higher not only in the U.S. but also in many other countries, exerting at least indirect pressure. Thus, inflation should be "contained," not "encouraged."

Regardless of today's BoE decision, we believe that the dollar should continue to decline. We see no reason for medium-term growth in the U.S. currency. In the daily timeframe, GBP/USD has bounced off the strong Senkou Span B line. Therefore, there are sufficient technical and fundamental grounds for a renewed rally in the British currency—even though the pound itself remains largely uninvolved in its own strengthening. There are very few macroeconomic events this week, but the new round of trade war escalation alone is enough to trigger another decline in the U.S. currency.

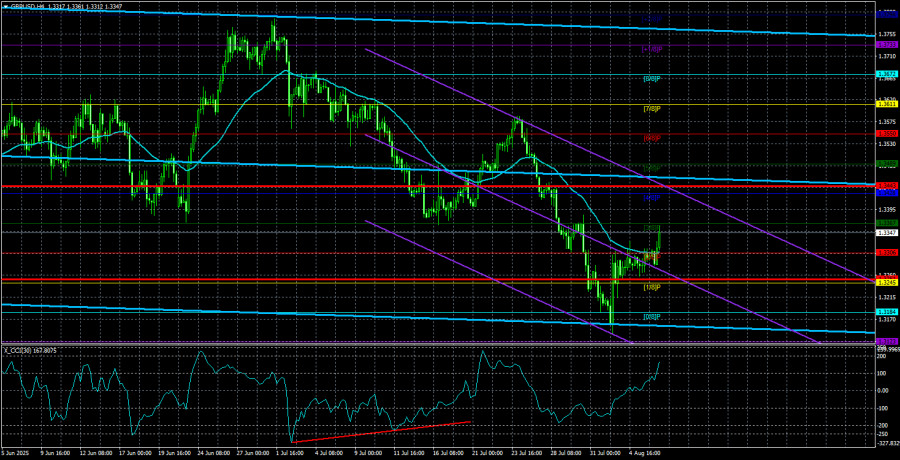

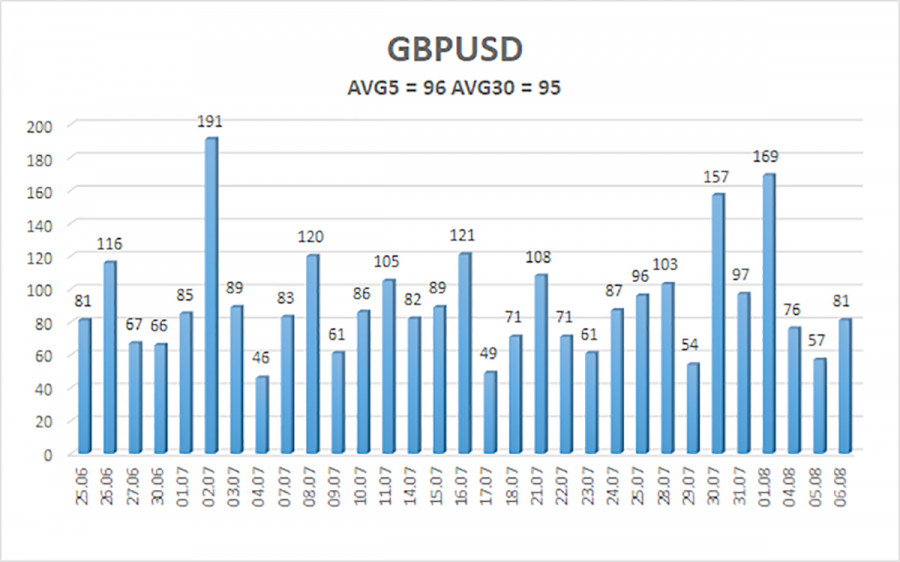

The average volatility of the GBP/USD pair over the past five trading days is 96 pips. For this pair, that figure is considered "high." Therefore, on Thursday, August 7, we expect movement within the range bounded by 1.3251 and 1.3443. The long-term linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has entered the oversold zone twice, signaling a possible resumption of the upward trend. Several bullish divergences have also formed.

Nearest Support Levels:

S1 – 1.3306

S2 – 1.3245

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3367

R2 – 1.3428

R3 – 1.3489

Trading Recommendations:

The GBP/USD currency pair has completed another round of downward correction. In the medium term, Trump's policies will likely continue to pressure the dollar. Thus, long positions with targets at 1.3550 and 1.3611 remain more relevant as long as the price stays above the moving average.

If the price falls below the moving average, small short positions can be considered with targets at 1.3245 and 1.3184, based purely on technical grounds. The U.S. currency occasionally shows corrective moves, but to strengthen in a trend-like manner, it needs real signs that the global trade war has ended, which now seems unlikely.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.