Analysis of Wednesday's Trades

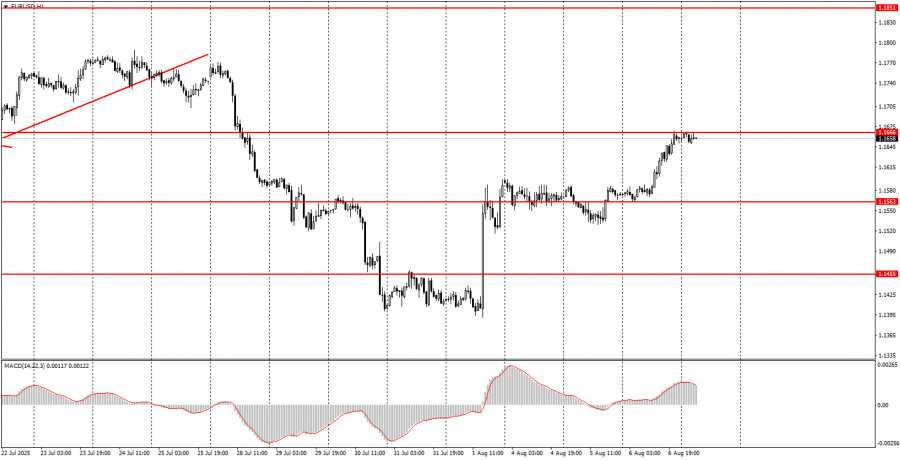

1H Chart of EUR/USD

The EUR/USD currency pair resumed its upward movement on Wednesday, just as we had warned. At first glance, it may seem that the market had no reason to start selling the dollar again—there were no significant reports throughout the day. However, we remind you that the flow of new tariffs and sanctions from the White House shows no signs of stopping. Just yesterday, Donald Trump announced new 25% tariffs against India, and by the evening, he had already raised them to 50%. Recall that India is unwilling to give up favorable Russian oil, while Trump wants to exert pressure on Moscow to stop the war in Ukraine. Thus, the U.S. president is threatening to impose "draconian" tariffs on all countries that purchase energy resources from Russia. In other words, Trump is killing two birds with one stone: on one hand, portraying himself as a global peacemaker; on the other, replenishing the U.S. budget with new import duties. Meanwhile, the market continues to evaluate Trump's protectionist policies very poorly.

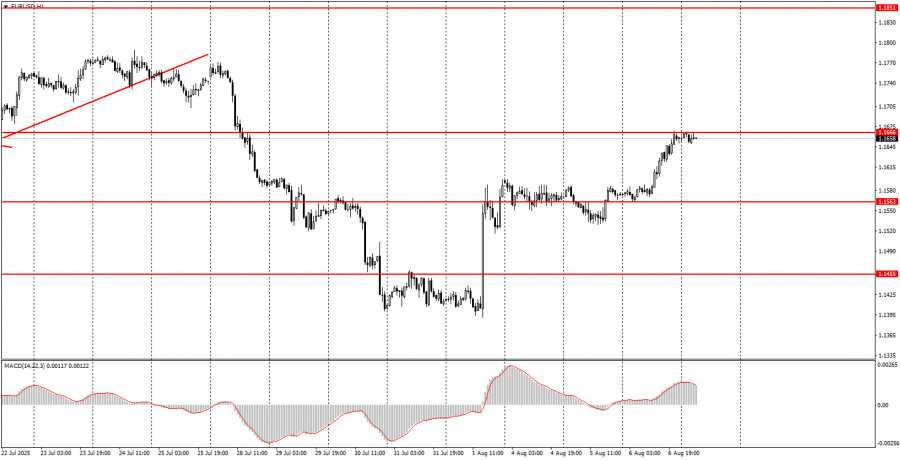

5M Chart of EUR/USD

On the 5-minute timeframe, exactly one trading signal was formed on Wednesday—but it was a perfect one. At the start of the European trading session, the price bounced off the 1.1571 level, after which it moved in only one direction throughout the day. By nighttime, the area of 1.1655–1.1666 was reached, where long positions could be closed with solid profit.

Trading Strategy for Thursday:

On the hourly timeframe, the EUR/USD pair has every chance to resume the upward trend that has been forming since the beginning of the year. The "house of cards" that is the U.S. dollar has collapsed. We have previously warned that there were no long-term fundamentals supporting dollar growth, and we questioned the so-called "optimism" related to Trump's policy and its initial results. Friday proved us right.

On Thursday, the EUR/USD pair may continue its move northward. After a break on Monday and Tuesday, the market seems ready to keep selling off the U.S. dollar. In addition to the weak labor market data, we note yet another tariff package from the generous American president—along with a new round of threats. To open new longs today, the price must break through the 1.1655–1.1666 area. In case of a rebound from this zone, small short positions with a target of 1.1571 can also be considered.

On the 5-minute TF, consider the following levels:1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1552–1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908.

No significant reports or events are scheduled in the Eurozone or the U.S. on Thursday. The only item worth noting is Germany's industrial production.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.