The EUR/USD currency pair declined slightly from its recent highs on Thursday, but this move had no real impact on the pair's overall direction. Even though there is virtually no major macroeconomic data this week, the fundamental backdrop remains very strong. Traders are still primarily focused on fundamentals related to the global trade war being fueled by Donald Trump. As we anticipated, there is no talk of ending or even de-escalating this conflict. All agreements signed by the White House are certainly favorable to the U.S. and its economy. However, they are not signs of de-escalation or truce.

What are the main points included in nearly all signed agreements? These are the same tariffs — and in some cases, even higher ones for trading partners than during the so-called "grace period." Essentially, these deals have raised tariffs even further for the EU or countries like Vietnam and Japan. The agreements also involve massive investments in the U.S. economy and obligations to purchase U.S.-made weapons, energy resources, and other goods and raw materials. Imagine a salesman pointing a gun at your head and demanding you buy a smartphone. Sure, you'll buy it — but can that be called a "truce"?

Thus, we believe the market now fully understands that there will never be a real truce. Trump will not lift tariffs or sign any truly mutually beneficial agreements. Current and future events related to the trade war can be labeled however one likes, but in essence, they reflect a new global trade framework dominated by Trump's dictates.

Most importantly, the U.S. President now feels free to demand anything from any country in the world. In other words, signing a trade deal today doesn't guarantee that new demands won't be made tomorrow — demands that will once again cost the counterpart country, either financially or politically. Markets now fully grasp that the American economy will grow due to inflows of investments and budget revenues — but who, going forward, would willingly choose to deal with America? Any relationship with the U.S. now risks leading to future complications.

This week, Trump imposed 50% tariffs on India for refusing to buy Russian oil and gas. He also announced upcoming tariffs on pharmaceuticals — potentially reaching a staggering 200% within two years — and on semiconductors. The list of so-called "injustices" that need urgent correction keeps growing by the week. Trump now appears to be inventing reasons and pretexts to impose tariffs on an increasing number of countries. In our view, this will eventually lead to a situation where countries start refusing to cooperate with the U.S., particularly in trade. Of course, not everyone will cut ties completely, but behind every country stands private business, and many companies may choose not to export their products to the U.S. out of principle. The American market is huge and wealthy — but it's not the only one in the world.

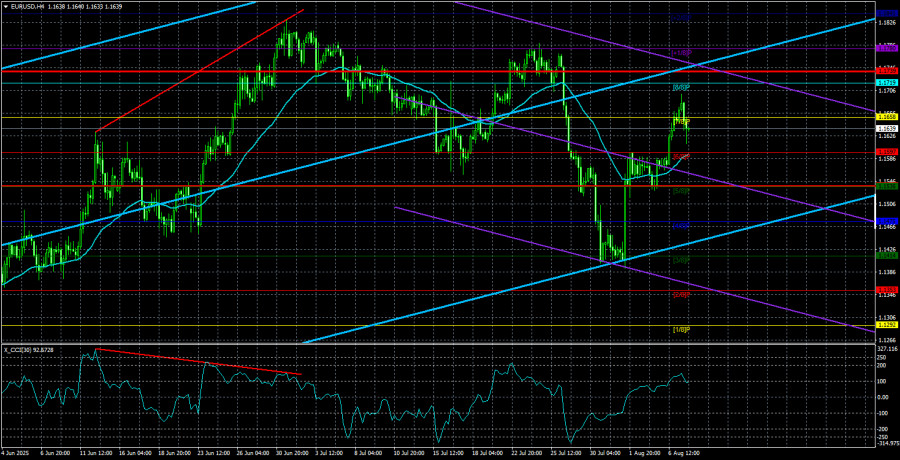

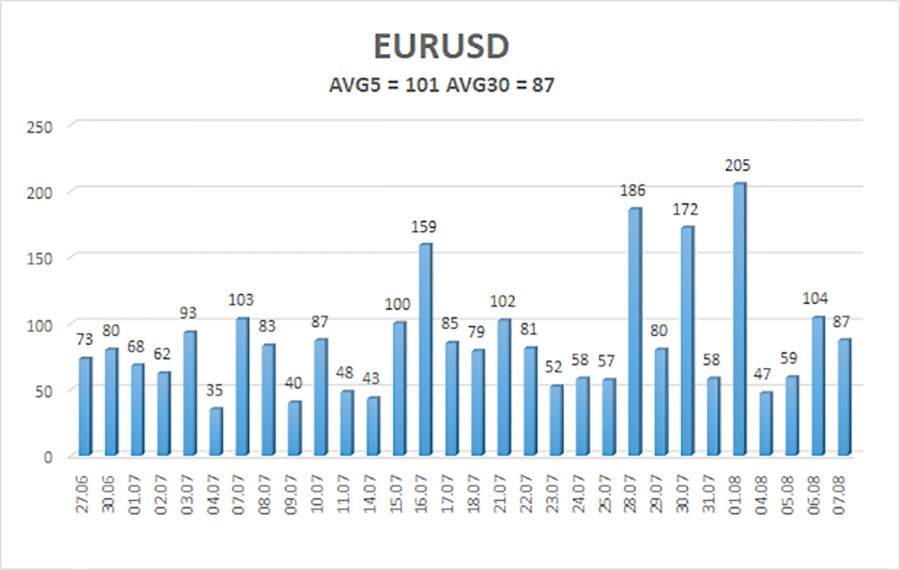

The average volatility of the EUR/USD pair over the last five trading days stands at 101 pips, which is classified as "high." We expect the pair to move between 1.1537 and 1.1739 on Friday. The long-term linear regression channel remains pointed upward, indicating a continuing uptrend. The CCI indicator has entered the oversold area for the third time, signaling a possible resumption of the bullish trend.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The U.S. dollar remains under heavy pressure due to Trump's policies — and he shows no signs of backing off. Last week, the world saw the consequences of that strategy. The dollar strengthened as much as it could — but now, it appears we may be entering a new extended decline.

If the price is below the moving average, short positions may be considered, targeting 1.1536 and 1.1475. If the price remains above the moving average, long positions remain relevant, with targets at 1.1719 and 1.1739, in line with the ongoing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.