Analysis of Trades and Trading Tips for the Euro

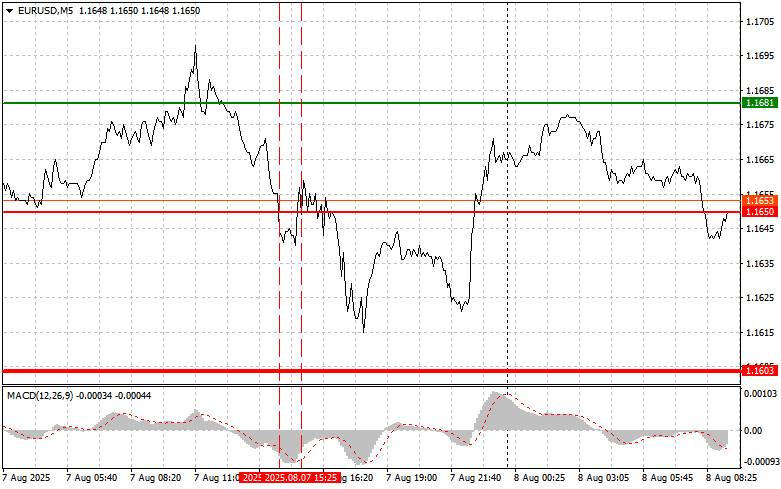

The first test of the 1.1650 level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of 1.1650, while the MACD was in the oversold area, confirmed a valid entry point to buy the euro under Scenario #2. However, the pair failed to rise, which resulted in losses.

Yesterday's statement from Federal Reserve representative Raphael Bostic, emphasizing the need to maintain a tight monetary policy, supported the U.S. dollar. As a result, the dollar strengthened against the euro. His comments underlined the Fed's commitment to fighting inflation, even if it means slowing economic growth. Bostic indicated that he expects rates to be held at current levels for the next several months — contradicting expectations from other Fed officials who are leaning toward near-term monetary easing.

However, it was later reported that U.S. President Donald Trump appointed a new Fed member, Stephen Miran, who is considered more loyal to him. Miran replaces Adriana Kugler, who stepped down from her post. This development weakened the dollar, as investors interpreted the appointment as a sign that interest rate cuts in the U.S. could accelerate. Miran's appointment sparked discussion about political pressure on the Fed and the potential loss of central bank independence. Investors began to bet that the new Fed member would support a more dovish monetary policy, which could lead to faster inflation and long-term dollar weakening.

Today's lack of economic data from the eurozone suggests that trading will likely remain within a narrow range. However, yesterday's developments — particularly the mixed signals from Fed representatives and political appointments — add further unpredictability to EUR/USD's short-term dynamics. In this context, market participants are advised to remain vigilant and take into account not only technical analysis but also fresh news and political statements.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Buy the euro today when the price reaches the area around 1.1667 (green line on the chart) with the goal of rising to 1.1710. At 1.1710, I plan to exit the market and also open a short position, expecting a 30–35 pip pullback from the entry point. The ongoing uptrend supports the euro's potential rise.

Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1635 level while the MACD is in the oversold area. This will limit the pair's downside potential and trigger a reversal upward. A rise toward the opposite levels of 1.1667 and 1.1710 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches 1.1635 (red line on the chart). The target will be 1.1590, where I will exit the market and buy immediately in the opposite direction, aiming for a 20–25 pip rebound. Strong downward pressure on the pair is unlikely to return today.

Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to decline from it.

Scenario #2: I also plan to sell the euro today if it tests the 1.1667 level twice consecutively, while the MACD remains in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.1635 and 1.1590 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.