The EUR/USD currency pair is showing all the signs of resuming the upward trend that could be named after Donald Trump. The decline of the US currency essentially began on the day of the president's inauguration. In other words, the market started to shed US dollars well before Trump began shaking the world with his decisions. Since the fundamental backdrop (which has been driving the dollar down for six months) has not changed recently, we expect only one thing: further dollar depreciation. We may have entered an "era of US currency devaluation."

This week, the dollar will have to pass several more tests. On Tuesday, the inflation report will be released — a figure that is becoming less and less relevant for the US currency. Previously, inflation was one of the main factors holding back the Federal Reserve. If inflation rose or stayed at an unacceptable level, the Fed maintained a hawkish stance with a 4.5% rate. We cannot say that this particularly helped the dollar in 2025, but perhaps it at least slowed its decline.

Now, however, US inflation is rising and will likely continue to rise, but labor market indicators have become the Fed's top priority. Since the last three NonFarm Payrolls reports all disappointed on the same day (which shocked markets), the Fed now needs to focus on saving the labor market rather than curbing inflation, the growth of which is fueled by Trump's policies. Inflation will simply have to be sacrificed. Consequently, even if it continues to rise, the Fed may still cut rates until the end of the year because the labor market needs support.

It hardly needs to be said what awaits the dollar once the US enters a new monetary easing cycle. If the US currency collapsed even when the Fed maintained a hawkish policy and the Bank of England and the European Central Bank were gradually easing, what can be expected now, when the BoE may take a long pause, and the ECB has essentially completed its key rate cuts?

Of course, the Fed could once again defy Trump, shift all responsibility onto him, and focus solely on inflation. But it should be remembered that Trump continues to pressure the central bank, seeks to bring it under his control, and has already started "restructuring" the Fed from within. Thus, cutting the key rate to astronomical levels (simply because that's what Trump wants) is only a matter of time. The dollar would fare better if the rate cuts were at least gradual. This will not prevent its decline, but markets would be able to prepare for the process.

In the Eurozone, GDP and industrial production data will be released this week. Over the past four months, industrial production has at least shown year-on-year growth, which is easily explained by the "low base effect." GDP in the second quarter may grow by no more than 0.1%. As we can see, even a low key rate has had little positive impact on the pace of economic growth in Europe, primarily due to Trump's tariffs.

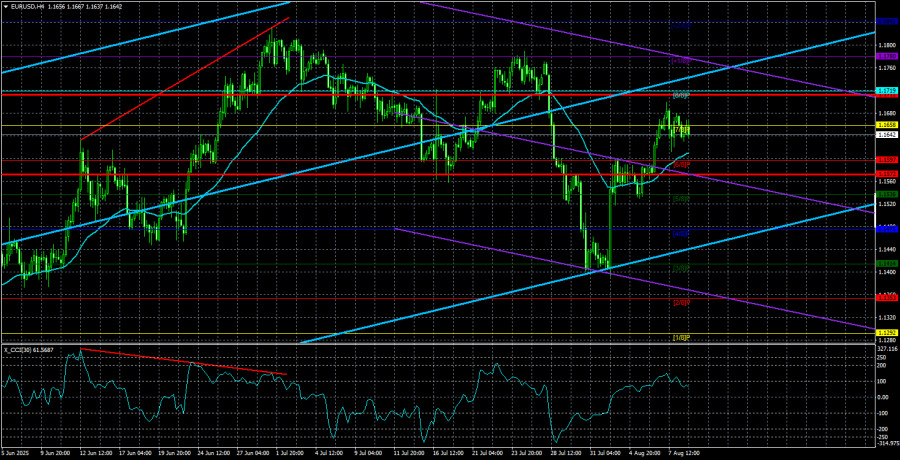

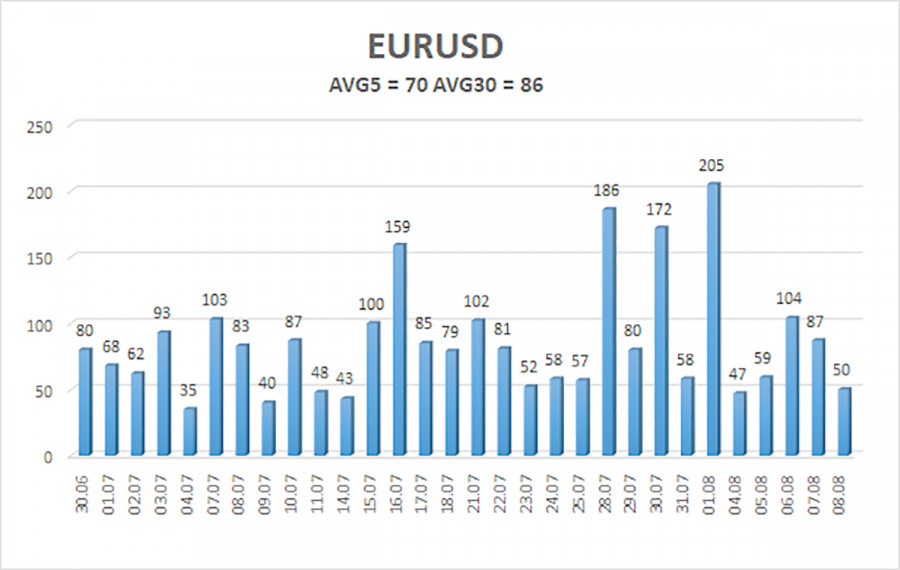

The average volatility of the EUR/USD pair over the last five trading days as of August 10 is 70 pips, which is considered "moderate." We expect the pair to move between 1.1572 and 1.1712 on Monday. The long-term linear regression channel is pointing upward, still indicating an uptrend. The CCI indicator has entered the oversold zone for the third time, which has repeatedly signaled a resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The US currency is still under strong pressure from Trump's policies, and he has no intention of "stopping here." The dollar has risen as much as it could, but now it seems the time has come for a new prolonged decline. If the price is below the moving average, small short positions with targets at 1.1536 and 1.1475 may be considered. Above the moving average, long positions with targets at 1.1719 and 1.1780 remain relevant in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.