Analysis of Trades and Trading Tips for the British Pound

The test of the 1.3440 price level occurred when the MACD indicator had just started moving upward from the zero mark, which confirmed a correct entry point for buying the pound and resulted in only a 15-point rise.

The speech by Federal Reserve representative Alberto Musalem was one of the key events last Friday, but it still went largely unnoticed by the market. The market is likely starting to gradually price in a Fed interest rate cut in September this year, which continues to put pressure on the dollar and supports the pound. In addition, the current market context should be taken into account. In recent weeks, volatility has been elevated due to the Bank of England's actions and the evident U.S. labor market data, which reinforces expectations that the policies of the two central banks will increasingly diverge. This again plays in favor of the pound. Therefore, the market's lack of reaction to Musalem's remarks does not necessarily indicate their insignificance. Instead, it reflects the current market situation, investor expectations, and the general level of uncertainty regarding the Fed's future policy.

Unfortunately, there is no news from the UK at all today, so the upward trend in the pair will likely persist. We may see some consolidation before the next breakout occurs, but the overall tone remains optimistic. Investors seem to be ignoring recession risks, focusing instead on the potential benefits of the BoE's policy. However, the risks should not be overlooked. Inflation in the UK remains high, and any unexpected deterioration could trigger a new wave of concerns and selling. Labor market data should also be monitored, as it can provide insight into the future direction of monetary policy.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

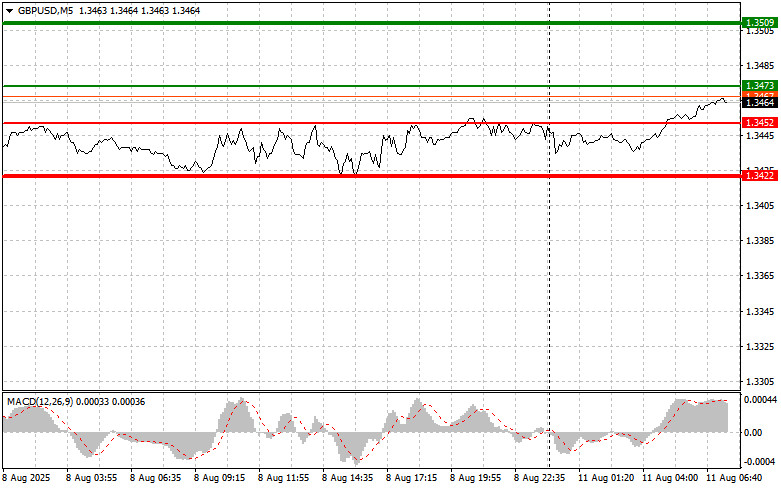

Scenario No. 1: I plan to buy the pound today if the entry point is reached around 1.3473 (green line on the chart) with the goal of rising to 1.3509 (thicker green line on the chart). Around 1.3509, I plan to close long positions and open short positions in the opposite direction, aiming for a 30–35-point move from that level. The expected rise in the pound would be in continuation of the bullish trend. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3452 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.3473 and 1.3509 can be expected.

Sell Scenario

Scenario No. 1: I plan to sell the pound today after it breaks below the 1.3452 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.3422, where I plan to close short positions and immediately open long positions in the opposite direction, aiming for a 20–25-point move from that level. Selling the pound today should only be considered as part of a minor correction. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3473 price level when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.3452 and 1.3422 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.