On Monday, the EUR/USD currency pair continued to trade in an extremely calm manner. The macroeconomic background was absent for the second trading day in a row, and the market is still more in the process of analyzing the fundamental backdrop than actually reacting to it. There are currently several highly significant and sensitive topics that market participants have likely not yet priced in.

First, there is the potential ceasefire between Russia and Ukraine. Second, there are Donald Trump's new tariffs, which in many ways depend on the negotiations between Kyiv and Moscow. Third, there is the possible global key rate cut by the Federal Reserve, which could begin in September.

As for the talks between Ukraine and Russia, there is little to say so far. Over the past three and a half years, both states have initiated negotiations several times, but each time they ended with nothing, as both Kyiv and Moscow want to get everything without making any concessions. If the delegations arrive in Alaska this time with the same demands, failure in the talks is guaranteed. No matter how influential Trump may be, he is not the ruler of the world, so the military conflict may continue.

Trump's tariffs should be divided into two categories: tariffs related to trade injustice toward the US and tariffs aimed at cutting off funding for the war in Ukraine. The first category is something well-established and familiar. Every few weeks, Trump imposes another batch of tariffs on those countries that, for reasons unknown to anyone, have somehow avoided them so far. Essentially, Trump believes that the entire world is using America for its own enrichment, while refusing to pay the bills, blocking access for American goods to their markets, and resisting a balanced trade relationship. Therefore, this category of tariffs will continue to expand like mushrooms after rain.

The tariffs connected to putting pressure on Russia are more interesting. On one hand, Trump is making every effort to bring Kyiv and Moscow to the negotiating table, even scheduling a personal meeting with Vladimir Putin, at which Volodymyr Zelensky may also be present. At the same time, however, Trump imposed tariffs on India in response to its refusal to purchase Russian oil, gas, and weapons. Now he is considering raising tariffs on China for the same reasons — while simultaneously conducting trade agreement negotiations with Beijing.

As we mentioned several months ago, Trump will continually seek reasons and pretexts to introduce new tariffs. The talks for a deal with China have not even concluded, but Trump is already preparing to introduce new tariffs. The US president is simply searching for convenient justifications for new sanctions, which simultaneously help fill the US Treasury. A very convenient scheme. Frankly, it makes no difference to us who Trump targets with tariffs, because it will be Americans who ultimately pay for them. Many countries' exports will suffer, but at this pace, sooner or later, the entire world will begin to reorient away from the US economy toward others, just as is currently happening with the US dollar. The process is slow, but everyone understands perfectly well that you "can't do business" with Trump — today you strike a deal, and tomorrow the US president imposes new tariffs.

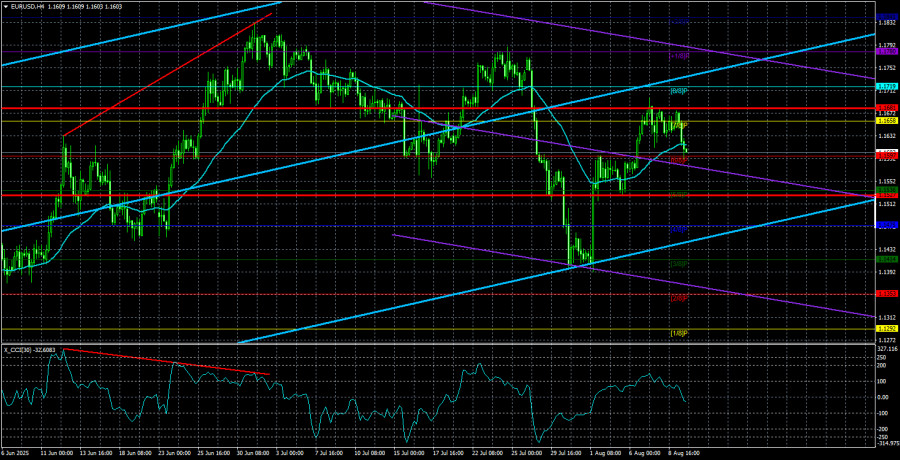

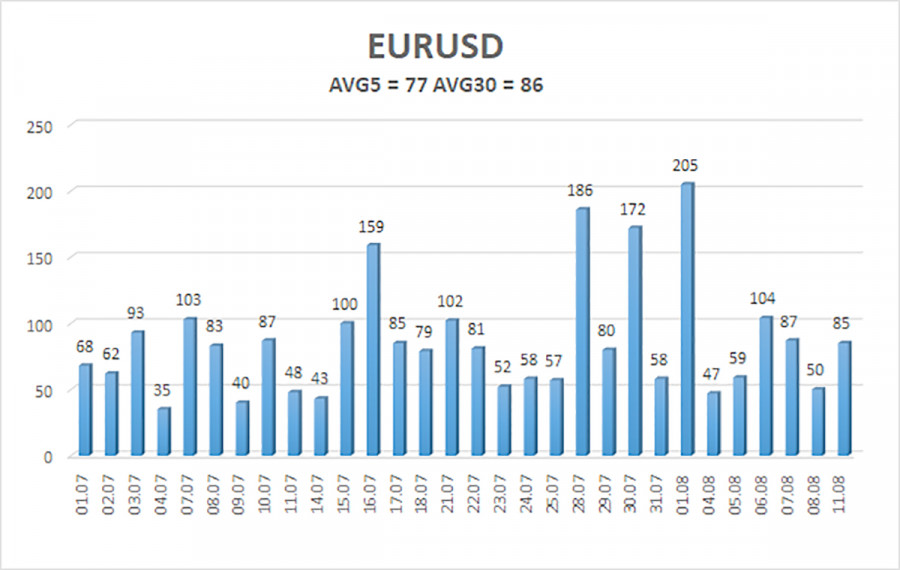

The average volatility of the EUR/USD currency pair over the last five trading days, as of August 11, is 77 pips, which is considered "moderate." On Tuesday, we expect the pair to move between 1.1527 and 1.1681. The long-term linear regression channel is pointing upward, still indicating an uptrend. The CCI indicator has entered the oversold area three times, signaling the potential resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The US currency remains strongly affected by Trump's policies, and he shows no sign of "stopping where he is." The dollar has risen as much as it could, but now it appears that a new stage of prolonged decline is approaching. If the price is below the moving average, small short positions can be considered with targets at 1.1536 and 1.1527. Above the moving average line, long positions remain relevant with targets at 1.1719 and 1.1780 in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.