The EUR/USD currency pair once again traded rather calmly. While the pair is not exactly stuck in place, volatility remains low. There is no clear sideways range at the moment, but there is also no trending movement. In my view, the market is waiting for the outcome of the talks between Donald Trump and Vladimir Putin, scheduled for Friday, August 15, in Alaska. We discussed this in detail in the GBP/USD article. For now, let's focus on more pressing matters.

By the fourth or fifth month of the trade war, the market had learned to react calmly to any new tariffs. In just the last few weeks, Trump has announced or imposed tariffs against more than 60 countries. Essentially, the U.S. president seems intent on levying tariffs on every country in the world — tariffs that American consumers will ultimately pay—a sad irony. Foreign countries will suffer from declining exports to the U.S., while American consumers will fill the federal budget, allowing Trump to take the stage holding a sheet of paper showing the current pace of U.S. economic growth.

Naturally, we will not see other sheets in Trump's hands showing the decline in the labor market, business activity, or inflation growth. The Republican promised a "golden age," and in essence, he has kept his word. Trump promised that the U.S. economy would be in recession for only a short time — and he did not lie. In the second quarter, the economy grew by 3%, which is well above even the most optimistic forecasts. As for all other indicators, the U.S. president will ignore them. Anyone who pays attention to them will be labeled a traitor.

Therefore, new tariffs no longer surprise anyone. The situation around the Federal Reserve also remains unusual and unfavorable. It is hard to say whether in U.S. history the Fed has ever lost its independence. If it did, it was a very long time ago. In any case, the Fed's independence is guaranteed by the Constitution, but Trump is probably the best politician in the world when it comes to skillfully bypassing legislation. It even seems that his team is not made up of experts in economics, negotiations, or sociology, but rather people who know how to find loopholes, run businesses, and make money out of thin air — and they are all skilled psychologists.

It appears that Trump is bringing an entirely new approach to U.S. politics — one in which the country is run not by subject-matter experts, but by people who are best at profiting from any situation. Trump has been a businessman all his life, and his politics are essentially one big business. Is this good or bad for America? It depends on the perspective. From the viewpoint of ordinary Americans, it's bad. From the standpoint of the country's elite, it's good.

Trump still has one problem to solve that could ruin everything for him — the elections. We do not doubt that, with the current electoral system, he would suffer a crushing defeat in four years. Therefore, he urgently needs to devise a strategy that will guarantee victory either for himself or for his chosen successor.

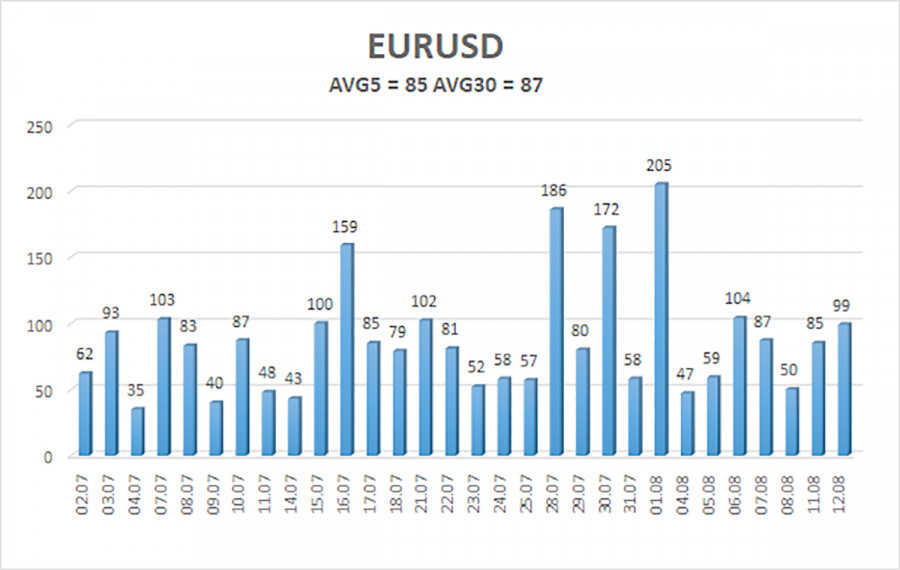

The average volatility of the EUR/USD pair over the last five trading days as of August 13 is 85 pips, which is considered "moderate." We expect the pair to move between 1.1590 and 1.1760 on Wednesday. The long-term linear regression channel is pointing upward, still indicating an uptrend. The CCI indicator has entered the oversold area three times, warning of a potential resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The U.S. dollar is still heavily influenced by Trump's policies, and he has no intention of "stopping where he is." The dollar has appreciated as much as it could, but now it seems time for a new prolonged decline. If the price is below the moving average, small shorts can be considered with targets at 1.1536 and 1.1475. Above the moving average, long positions remain relevant with targets at 1.1719 and 1.1760 in continuation of the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.