MobileTrader

MobileTrader: trading platform near at hand!

Download and start right now!

13.08.2025 03:03 PM

13.08.2025 03:03 PMA new wave of market volatility has swept across global trading floors, as investors worldwide closely monitor fluctuations in energy prices—particularly oil and natural gas—alongside fresh assessments from leading analytical agencies.

On Wednesday, during the European session, market participants remained focused on production prospects, demand trends, and the impact of geopolitical events, such as the upcoming Russia–US leaders' summit.

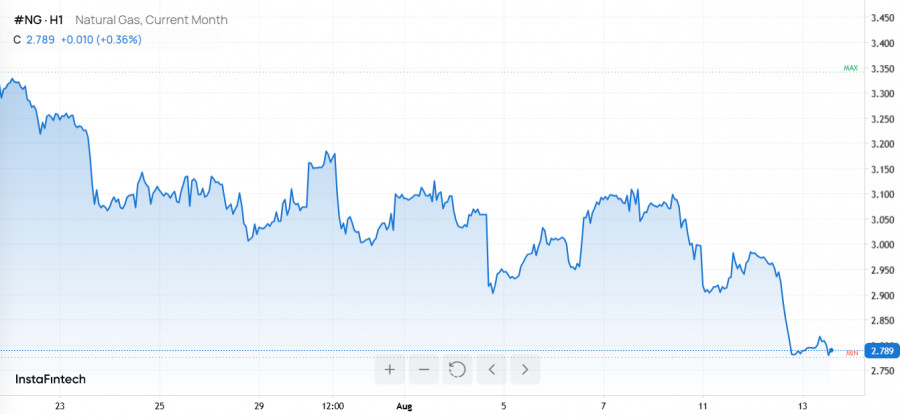

At the New York Mercantile Exchange (NYMEX), September natural gas futures showed resilience, settling at $2.81 per million British thermal units (MMBtu), virtually unchanged from the previous session. During the day, gas tested the lower support boundary at $2.774 and met resistance around $3.106 per MMBtu. Trading volumes increased, which may signal upcoming changes in the market.

Against the backdrop of stable gas prices, the U.S. dollar weakened: the USD index, which tracks the greenback's performance against six major currencies, fell by 0.46% to 97.48.

Other key energy commodities also showed negative momentum: September WTI crude futures fell 0.7% to $62.73 per barrel, heating oil dropped 0.67% to $2.23 per gallon, and Brent crude slipped 0.65% to $65.69 per barrel—its first two-month low.

In its latest monthly report, the International Energy Agency (IEA) significantly raised its 2025 global oil supply growth forecast to 2.5 million barrels per day (bpd), up by 400,000 bpd from its previous estimate. The key catalyst was the decision by eight OPEC+ members (under voluntary production limits) to raise output by an additional 547,000 bpd in September. Since April, cartel participants have been steadily increasing production to fully unwind the cuts implemented in 2023.

However, despite the positive supply-side outlook, the IEA lowered its global demand forecast, projecting growth of 680,000 bpd—down from the previous 700,000 bpd estimate. The agency noted that consumer activity remains weak in major economies, while demand expectations for developing countries such as China, Brazil, Egypt, and India have been revised downward.

The US Energy Information Administration (EIA) forecasts that average Brent crude prices could drop to $50 per barrel by early 2026 due to rising inventories amid expanding OPEC+ production. The EIA also cut its Brent price forecast for 2026 from $58 to $51 per barrel. US crude output is expected to reach a record 13.6 million bpd in December 2025 before gradually declining toward the end of 2026.

OPEC itself maintains cautious optimism, raising its 2026 global oil demand forecast by 100,000 bpd to 1.4 million bpd, while slightly lowering its projected supply growth from non-OPEC producers.

Geopolitics remains in the spotlight: ahead of the upcoming summit in the US, the Russian and US foreign ministers held working consultations, while Ukraine's president is insisting on Kyiv's participation in the talks. Meanwhile, according to API estimates, US crude inventories rose by 1.5 million barrels last week, slightly exceeding market expectations.

India's market dynamics further highlight global instability. Nayara Energy, linked to Russia, shipped a diesel cargo to China for the first time since 2021 amid EU sanctions pressure. Indian refineries are increasingly engaging in spot deals to hedge supply risks from Russia.

Natural gas trends remain mixed: while futures retain potential for further decline, the latest EIA forecast sees the Henry Hub spot price averaging $3.90 per MMBtu in Q4 2025 and rising to $4.30 in 2026. The drivers are steady production levels and growing US LNG exports. Additional momentum in the gas market comes from increased electricity consumption by data centers, along with industrial and commercial demand.

Given the current situation—rising oil supply alongside slowing demand, coupled with gas market volatility—traders can pursue both bearish and bullish strategies on these instruments. Closely tracking IEA, EIA, and OPEC releases and reacting promptly to news is key to successful energy trading. Price swings present opportunities for short-term speculation, long-term hedging, and portfolio diversification.

Oil and gas futures, along with other energy-sector derivatives, are available for trading to InstaForex clients. Stay updated with key news, use the InstaForex platform to remain informed of the latest developments, and make the most of new market opportunities.

MobileTrader: trading platform near at hand!

Download and start right now!

You have already liked this post today

*Disclaimer: The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have any content questions, please contact editorial-board@instaforex.com

If you have any content questions, please contact editorial-board@instaforex.com