GBP/USD 5-Minute Analysis

On Wednesday, the GBP/USD currency pair continued its upward movement, despite the absence of significant reports, news from Donald Trump, and fundamental events during the day. Once again, we draw traders' attention to the fact that another dollar decline does not require any local news. Of course, the market cannot and will not sell the U.S. currency every single day. Corrections, pullbacks, and pauses are necessary. However, when we see another seemingly unfounded drop in the dollar, there is no reason to be surprised. The fundamental background is strong enough to provoke regular selling of the U.S. currency.

Thus, the British pound is rising again without making any particular effort. The dollar is on the verge of two potential setbacks — and only two if Trump does not continue imposing tariffs on every country he can remember exists. Without that, the dollar remains at risk due to the possibility of a ceasefire between Ukraine and Russia, as well as the upcoming Federal Reserve key rate cut. Let us recall that the dollar declined steadily throughout the first half of the year, even without Fed monetary policy easing.

In the 5-minute time frame, the pound has been forming an excellent buy signal at the very start of the European trading session for the second day in a row. This time, the price broke above the 1.3509 level and then managed to rise about 50 pips. Traders could have easily captured these 50 pips. Most likely, the upward movement will continue, with the target at 1.3615.

COT Report

COT reports on the British pound show that in recent years, the sentiment of commercial traders has been constantly changing. The red and blue lines representing net positions of commercial and non-commercial traders frequently cross and, in most cases, remain close to the zero mark. Right now, they have converged again, indicating an approximately equal number of buy and sell positions.

The dollar continues to fall due to Trump's policies, so in principle, the demand of market makers for the pound is not particularly important at this point. The trade war will continue in one form or another for a long time, and demand for the dollar will keep falling. According to the latest report on the British pound, the "Non-commercial" group closed 22,100 BUY contracts and 900 SELL contracts. As a result, the net position of non-commercial traders decreased by 21,200 contracts over the reporting week.

In 2025, the pound experienced a sharp rise, primarily due to Trump's policies. Once this factor is removed, the dollar may resume growth, but no one knows when that will happen. It doesn't matter how quickly the net position in the pound is rising or falling — in the dollar, it is falling in any case, and usually at a faster pace.

GBP/USD 1-Hour Analysis

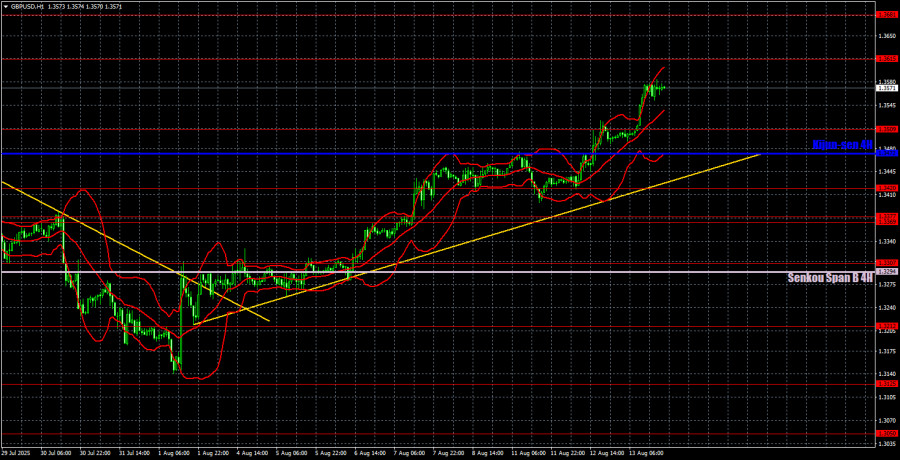

On the hourly chart, GBP/USD continues to form an upward trend, while on the daily chart, it has bounced off the important and strong Senkou Span B line. In our view, the fundamental backdrop remains unfavorable for the U.S. currency, so in the long term, we expect the continuation of the "2025 trend." All recent news and events have done nothing but add pressure to the dollar.

For August 14, we highlight the following key levels: 1.3125, 1.3212, 1.3369–1.3377, 1.3420, 1.3509, 1.3615, 1.3681, 1.3763, 1.3833, 1.3886. The Senkou Span B (1.3294) and Kijun-sen (1.3472) lines may also generate signals. We recommend moving the Stop Loss to breakeven once the price moves 20 pips in the right direction. The Ichimoku indicator lines can shift during the day, so this should be taken into account when identifying trading signals.

On Thursday, the UK will publish Q2 GDP and industrial production reports. These are important releases, unlike similar European data. In the U.S., macroeconomic data will be of secondary importance.

Trading Recommendations

We believe that on Thursday, the pair's upward movement may continue. The price has broken above 1.3509, so it could move further toward 1.3615. If this level is also broken, the next target will be 1.3681. A rebound from 1.3615 could be used to open short positions. UK data should not be ignored today. The most important day of the week will be Friday.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.